Hemp has been a plant shrouded in myth, mystique and misinformation for decades, as federal prohibition in the United States kept it out of farm fields and out of mind. This shroud has been slowing lifting over the past few years, first as state-level rules relaxed, and then as the 2014 farm bill allowed for federally approved experimental hemp plots. Then, the passage of the 2018 farm bill legalized the production of industrial hemp on a federal level, throwing hemp into the spotlight overnight, and creating a gold rush of interest and investment in the long-overlooked crop.

Already, growers are ramping up hemp production, with an estimated 77,000 acres planted in 2018. Agronomists and other researchers are mapping out the specifics of the crop, and particularly the factors determining production of its famous terpenes tetrahydrocannabinol (THC) and cannabidiol (CBD). Processors are drawing licenses and investing in equipment to turn that CBD into tinctures, capsules, gummies, salves and more, as well as to process hemp seeds for food, and hemp fiber for a variety of uses including textiles and paper. Certifiers are developing and implementing programs to certify organic hemp.

“Hemp will become a commodity crop, just like corn and soybeans…and it’ll get there quickly, because it’s valuable,” said Mason Walker, CEO of East Fork Cultivars in Oregon, and a man who has watched the hemp industry closely as a farmer, businessman and advocate. “We’ll see more diverse markets emerge with hemp. Right now, cannabidiol (CBD), the therapeutic molecule you find in the resin of the cannabis flower…that’s the vast majority of the market in terms of dollars. Over time, we’ll see a more balanced market with more diverse uses for the crop. The fibers can be used for rope, paper, construction materials and other industrial uses. The seed is used for food, for cooking oils and then industrial oils and biofuels as well. You’ll see a lot of diversification in uses of the plant; it’s a very versatile plant.”

Part of that diversification will likely be the rise of craft hemp, and as we’re already seeing, organic hemp.

A New Frontier for Organic

In the frenzy swirling around hemp, organic production might seem like an afterthought. But, it shouldn’t. Organic certification makes a lot of sense for the hemp market, and particularly for CBD, a product that many are buying with an eye on their health.

“Folks reach out to us because we have organic hemp flower,” said Walker. “There are other things we do with quality and sustainability, but the organic label definitely helps, and we get a premium for it. You’ll see organic certification go deeper into the space — right now, farms are certified, but you’ll see it for processors, distributors — certification will go further into the product life cycle. The hoops that we have to jump through are not new to hemp, but are the same hoops anyone growing a new organic crop would go through. The market is figuring out how to make different parts of the market organic. Like, for example, organic hemp seed: we’re working on creating that; right now it doesn’t exist. The regulatory stuff is certainly a hurdle, but now we have certifiers willing to play ball, and some guidance from the USDA [United States Department of Agriculture].”

One might be forgiven for thinking that hemp would grow like a weed, whether grown conventionally or organically. But this is not so, said Ben Dobson, an organic hemp grower at Hudson Hemp in New York State.

“Is hemp easy to grow organically?” said Dobson. “It is and it isn’t. There’s a myth that hemp is great at beating out weeds. Once it’s six feet tall that’s true, but in that first month it’s actually a slow grower. Fertility-wise it’s a heavy feeder, but it’s not impossible. The biggest risk is mildew, especially here on the East Coast where we get so much rain.”

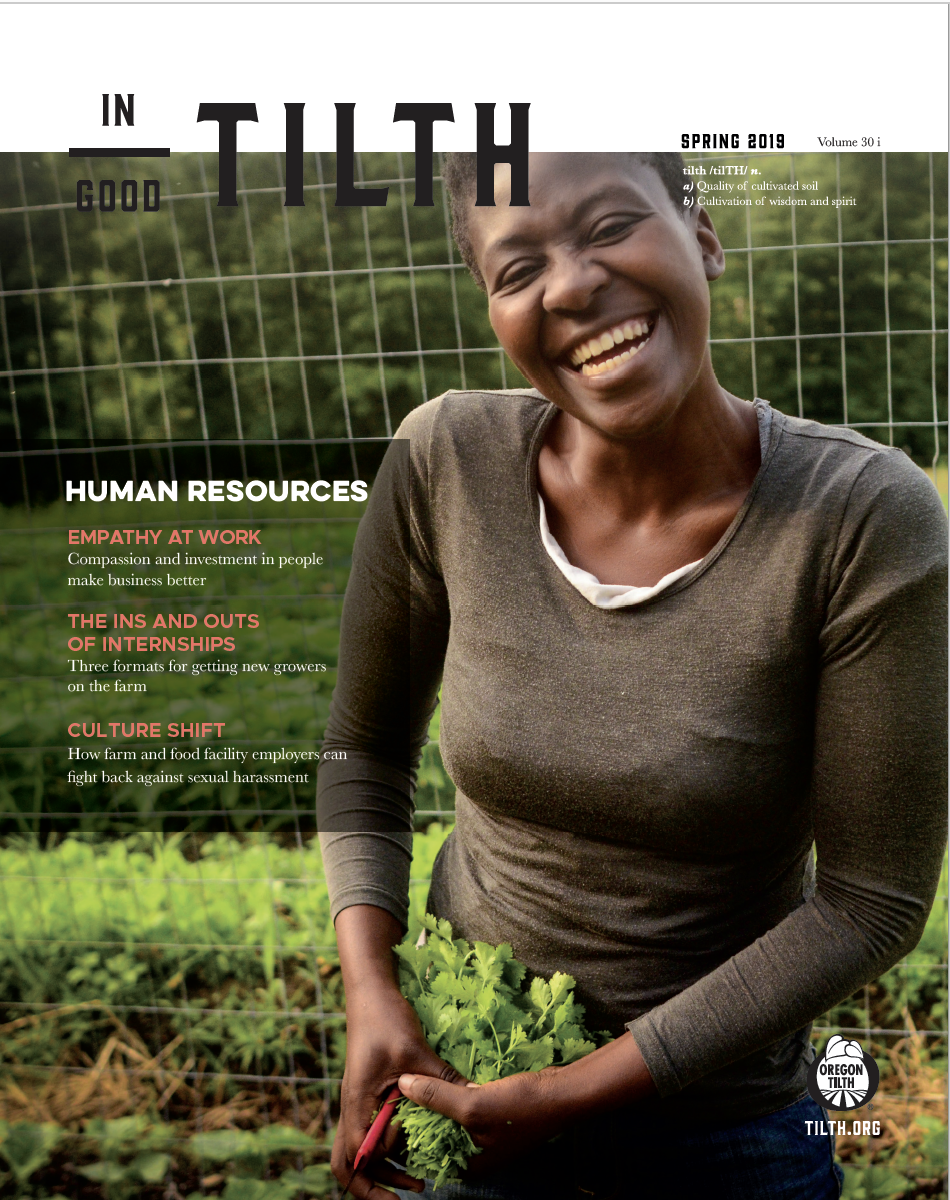

Photo by Olivia Ashton

A Rocky Road Ahead

There’s good reason to be optimistic about the future of hemp, whether organic or conventional. In the near term, however, business, agronomic and regulatory obstacles are likely to claim many hemp pioneers. There will be growing pains in getting hemp production from the small number of experimental plots permitted by the 2014 farm bill to the acreage required to support a multibillion dollar industry. Hemp will also face logistical headaches of an emerging market, like unreliable business partners, supply chain dysfunction and lack of established trade groups, financial products and business support.

Right now, hemp growers don’t even have access to basic business services. “All those things that, to other businesses, are not issues anymore, they’re still issues for hemp because of its transitional stage,” said Walker, “Even though the 2018 farm bill passed and made hemp legal federally, there are still a lot of hurdles to running a basic business. There’s a legal path to getting crop insurance, but we still can’t; nobody’s providing it yet. There’s a path to getting banking services, but there are no national, accredited, insured banks offering basic banking services above-board to hemp companies.”

Hemp will not escape the pests and pathogens that plague all crops, either. “One thing we have to be prepared for, whether you’re talking about conventional or organic production, is that when you introduce a crop that’s not been grown widely for a while, there may not be that many pests initially,” said Bob Pearce, an agronomist at the University of Kentucky studying hemp production. “But as you build up the concentration of that crop, and particularly as you grow the same crop year after year, eventually you’ll see some of those pests come in. We may have a bit of a grace period, and then some of the pests and disease will build up.”

Regulatory Risks

And then there’s the 800-pound gorilla in the room: the possibility of regulators taking a hostile posture towards hemp. State and federal regulators from an alphabet soup of agencies are busy drafting the rules that will govern hemp production and shape the nascent industry. The final shape of those rules is as mysterious as the plant itself.

Currently, several federal agencies, including USDA, Food and Drug Administration (FDA) and Drug Enforcement Administration, are each drafting and reconsidering their own sets of rules about the cannabis plant, and these rules don’t always align. Hanging over the whole industry is the very real possibility of a change in rules, or even definitions. As the legacy of decades of prohibition slowly unwinds, people’s livelihoods are caught up in questionable legal distinctions. Is CBD a drug, a food additive or a health supplement? Are hemp and marijuana the same plant?

A Supplement, a Food or a Drug?

The USDA, which oversees hemp production under the rules laid out in the 2018 farm bill, allows for the sale of that hemp to processors making CBD. However, that CBD production is in a legal gray area due to the rules from another federal agency, the FDA.

Since CBD is the main active ingredient in Epidiolex, a recently approved prescription drug, it can’t be included in food and health supplements per FDA rules. Right now, hemp growers and processors supplying the CBD market are living under an uneasy detente, as the FDA mostly declines to enforce its own rules.

“Right now, the FDA says you’re not supposed to put CBD in food or health supplements, which are the two major ways CBD is sold currently,” said Mason Walker. “So if they start cracking down on that, deputize health departments, it could really dampen the market.”

A Tale of Two Plants

In the eyes of the Federal government, the distinction between hemp and marijuana is clear: marijuana is an illegal, intoxicating Schedule I drug, with the active ingredient of THC. Hemp is a newly legal crop, with a THC content of less than 0.3 percent by dry weight.

Nature, however, does not respect the rules of the U.S. federal government, and the distinction between hemp and marijuana is less like that between dog and cat, and more like the difference between a Chihuahua and a Great Dane. They make a very different impression and are treated differently in the world, but all of the distinctions between them are differences of degree, not of kind. And, every point between them is biologically viable.

Both crops are hybrids of three species, Cannabis sativa, Cannabis indica and Cannabis ruderalis. Hemp and marijuana look the same structurally, and both produce the psychoactive cannabinoid THC, a terpene that is part of the plant’s defense system. Hemp is defined as cannabis with less than 0.3 percent THC, but THC content is not a fixed variable. Hemp varieties with genetics that typically result in less than 0.3 percent THC can exceed the legal limit if harvested too late, or exposed to too much stress.

Further complicating this picture, CBD and THC are on two different branches on the same biosynthetic pathway, so higher CBD content typically means higher THC content. Since the majority of hemp grown in the U.S. today is harvested for CBD, that is a serious concern for growers.

“We want the highest possible CBD content without being hot on THC,” said Ben Dobson. “We’ve found that to be in 8-11 percent CBD range; once you go over that, it’s hard to not be hot. I don’t care what anyone says, it’s pretty much a ratio — between 30:1 and 40:1 is where I’ve seen the best genetics land.”

State agricultural departments typically require that producers notify them before a harvest, and they will send an inspector to come in and test the THC content. If the crop comes in “hot,” or above 0.3 percent THC content, the producer must destroy the crop. Since most hemp is currently grown for CBD, this poses a real financial challenge, particularly without crop insurance.

A Green Future

Despite these considerable risks and uncertainties, hemp’s future is clear. Reputable sources like the Brightfield Group estimate that the CBD market alone could be worth $20 billion by 2022. Hemp pioneers are navigating a patchwork of market and regulatory uncertainties to meet a voracious market, which is only starting to gear up. While the risks in the market are real, so are the rewards.