Prior to the Controlled Substances Act of 1970, hemp was widely grown in the United States for its durable fibers and nutritious seeds. But, the law didn’t distinguish between hemp and its psychoactive cousin, marijuana, rendering hemp illegal.

Over the past several years, however, incremental changes have begun to loosen these restrictions, culminating in the passage of the 2018 farm bill lifting restrictions on growing, selling, transporting and possessing hemp and hemp-derived products in the United States. While some regulations remain — hemp growers must be licensed, and hemp must test below a 0.3 percent tetrahydrocannabinol (THC) threshold — growing hemp is back within reach for more farmers than ever before.

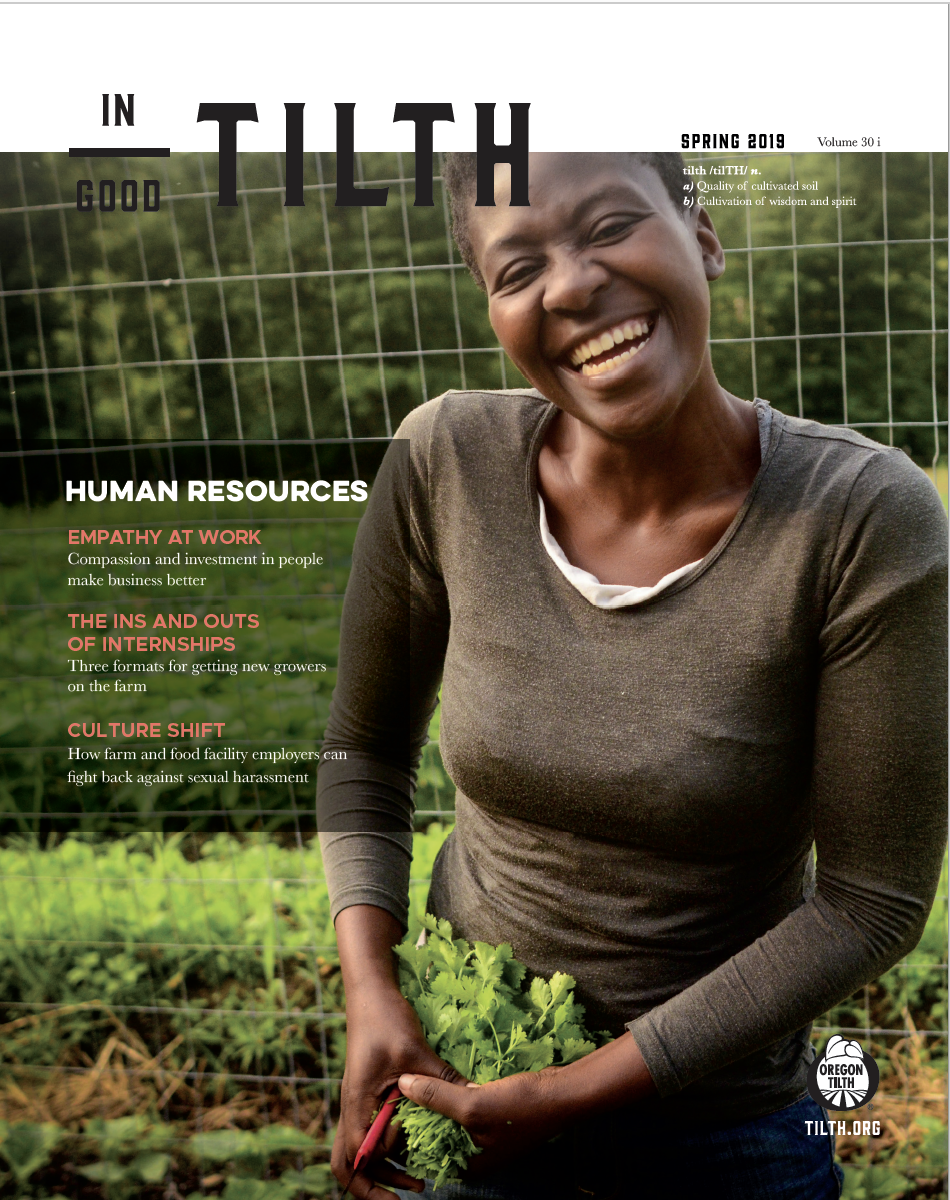

CBD through its processing lab, SunGold Botanicals. Photo by Heather March

But today, it’s not rope or seeds driving hemp’s growth. Cannabidiol (commonly referred to as CBD) is now the most desirable part of the hemp plant. This naturally created compound is credited with a wide range of health benefits, from treating seizures in children to addressing anxiety and insomnia. The first CBD-derived drug was recently approved by the Food and Drug Administration, and it is now ubiquitous in supplements, cosmetics, personal care products, foods and beverages.

In 2018, spending on CBD products reached $1.9 billion, according to BDS Analytics. By 2024, that figure is expected to be $20 billion. At a time of flat commodity crop pricing and rumbling trade wars, the attraction for farmers is enormous, and not only for those already growing cannabis products. Vegetable and grain farmers are finding hemp can weave its way neatly into crop rotation, generating a valuable new source of revenue. Marijuana growers squeezed by rocky markets in many parts of the country are also pivoting to hemp. But when it comes time to harvest, many growers are confronted by a familiar dynamic: the processor bottleneck.

Processing

Much like soy or corn, hemp must be processed before it can be commercialized. CBD is heavily concentrated in the hemp plant’s flowers, which are harvested in late summer and early autumn. Those flowers must then undergo extraction, a process that requires numerous pieces of expensive, specialized equipment. The flowers are soaked in high-proof neutral alcohol to extract the CBD, typically at extremely low temperatures to maximize efficiency. That liquid is then distilled under vacuum to remove the alcohol, leaving behind a thick, tarry substance called crude CBD, which has an intense smell and pleasant flavor. In applications where that flavor isn’t desired (like, say, a line of CBD-infused citrus seltzers, or mango-scented CBD lip balm), the crude can be further refined using additional distillation and/or chemical solvents.

Many hemp growers are finding a shortage of available processors for their crop, especially certified organic processors.

“There definitely is a bottleneck,” said attorney Courtney Moran, founder of EarthLaw LLC. She’s also the president and lobbyist for the Oregon Industrial Hemp Farmers Association, as well as the chief legislative strategist for Agricultural Hemp Solutions, a government affairs firm involved in passing comprehensive industrial hemp legislation. “And, the bottleneck is not just in Oregon. It’s nationally.”

Moran said that as of spring 2019, some processors were still processing crops from 2017 or even 2016, leading to delayed payments for farmers. Some growers are responding by doing processing themselves, while others are relying on the small but growing pool of contract processing providers.

“More processors are coming online every day,” said Moran. “But, the backlog is still affecting what’s happening today.”

Vertical Integration

Josh Gulliver has been involved in organic agriculture for years as a vegetable and cannabis grower. When he began growing hemp, he took his organic practices with him, even though there were few financial incentives to do so.

“There was zero financial gain being organic for the first couple of years in this industry, primarily because there were no organic processors online,” said Gulliver. “You couldn’t take your product and actually add value through the finished product.”

In other words, you could grow your hemp organically, but once it was processed at a noncertified facility, the resulting CBD lost its organic certification. “So, we decided the best thing for us to do was create that,” said Gulliver.

He and his business partner, John Eveland, started SunGold Botanicals, an organically certified CBD processing lab, in 2019 in Philomath, Oregon. Processing began in March. To help run the facility, the two brought in Isaac Daniel, now co-owner of SunGold Botanicals, as a technical expert in CBD processing.

As Daniel led a tour of the processing floor, it became clear just how technical the process is. SunGold Botanicals macerates its hemp flowers in organic, high-proof ethanol at extremely low temperatures, as low as 90 degrees Celcius.

“By ultrachilling it, basically you’re doing two things,” said Daniel. “One, it’s a better solvent for picking up cannabinoids. And, I’m also picking up less undesirables like lipids and chlorophyll.”

Next, the maceration is centrifuged and filtered to extract the solids, resulting in a liquid that looks like tea. That’s fed into a rotary evaporator, a piece of equipment that looks like it is straight from a mad scientist’s laboratory. The CBD-laden alcohol goes into a large, globe-shaped glass bulb, which spins in a pool of warm water, providing a gentle heat source. The entire interior of the system is placed under vacuum, which lowers the alcohol’s boiling point and causes it to evaporate, leaving the CBD and other cannabinoids behind. The alcohol is recovered using a condenser and can be reused.

Over time, the thin liquid in the glass globe is reduced to a dark green color and viscous texture. A second boiling process ensures all the alcohol has been evaporated and removes off other undesirable compounds, leaving only a thick, sticky, honey-like substance with a pungently verdant aroma. As the samples were passed around to smell, the enormous boxes of hemp flowers were visible, stacked several layers high on the other side of the warehouse, all waiting their turn for processing — a vivid illustration of the backlog to which Moran referred.

SunGold Botanicals is a small facility, and virtually all of its capacity is allocated to the 35 acres of hemp Gulliver and Eveland will grow this year under their cultivation company, J&J Organics. Gulliver says SunGold Botanicals is only able to provide contract services to a few carefully selected growers at this time, all of whom are hungry for the ability to market their extracts as certified organic.

Contract Processors

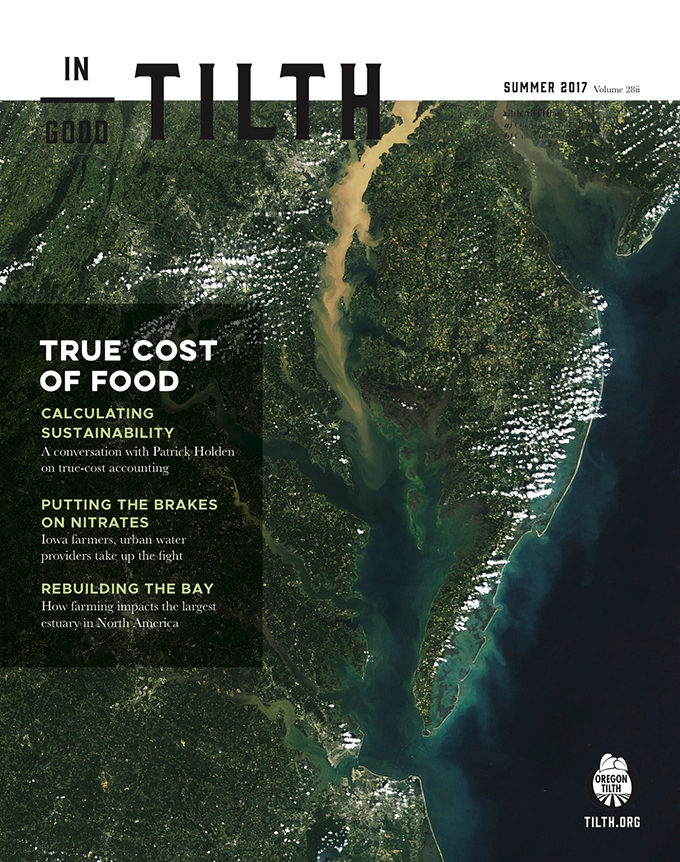

On the other side of the Cascades in Culver, Oregon, Freedom Hemp Co. is undertaking a major processing facility expansion to meet its own growing needs and expand its contract capacity. Founded in 2016, Freedom Hemp Co. handles everything from seed growing and plant genetics, to product commercialization. Currently, its onsite processing and extraction lab is only big enough to process its own crop. Once the new facility is complete, it’ll have the capacity to help other growers.

“Our new lab will do 50,000 pounds of biomass every 24 hours,” said cofounder and chief operations officer Brian Smalley. “And that’s phase one.”

Smalley estimates Freedom Hemp Co.’s processing facility will be the largest on the West Coast. The team is also pursuing organic certification for the processing facility.

While a significant amount of that capacity will be reserved for Freedom Hemp Co.’s own crops from 2,400 acres under cultivation, the company will also be taking on contract clients.

Plant cultivation at Freedom Hemp Co, whose new processing facility is expected to be the largest on the West Coast. Photo by Amanda Long

“Once the facility’s done, we can process for all of central Oregon,” said Smalley. “We have a railroad spur that comes right to our building. We could even serve the Midwest.”

One issue taking shape at Freedom Hemp Co. and other processors is a buildup of stalk and leaf biomass left over from hemp processing. Hemp stalks are tough and fibrous (they’re used to make rope, after all). They need to be ground up to break down effectively in a compost system. Without the specialized equipment to do that, hemp biomass becomes a high-volume headache.

“We’ve had a bunch of people approach us for using it as cattle feed,” said Smalley, “But the process you have to go through with ODA [Oregon Department of Agriculture] is painstaking. So for now, we’re saving it.”

Pellets for wood stoves is one potential use. Another is “hempcrete,” a biocomposite building material made from combining hemp fibers with a lime-based binder. It’s so lightweight that it floats in water, yet has excellent insulating properties. Smalley said American building codes don’t quite know what to make of the fiber yet, but Freedom Hemp Co. plans to hire a lobbyist to promote its use in the United States.

The hemp-derived CBD industry will need a lot more processors before it can reach that projected $20 billion in revenue BDS Analytics predicts. Like everything in cannabis, the landscape is changing fast, and every month seems to bring new developments, new entrants and new regulations. For now, growers interested in breaking into the market are finding it’s a good idea to secure processing well before harvest time, especially if the crops are destined for anything with an organic certification on the label.